6 Advantages of Digital Patient Financial Engagement Solutions

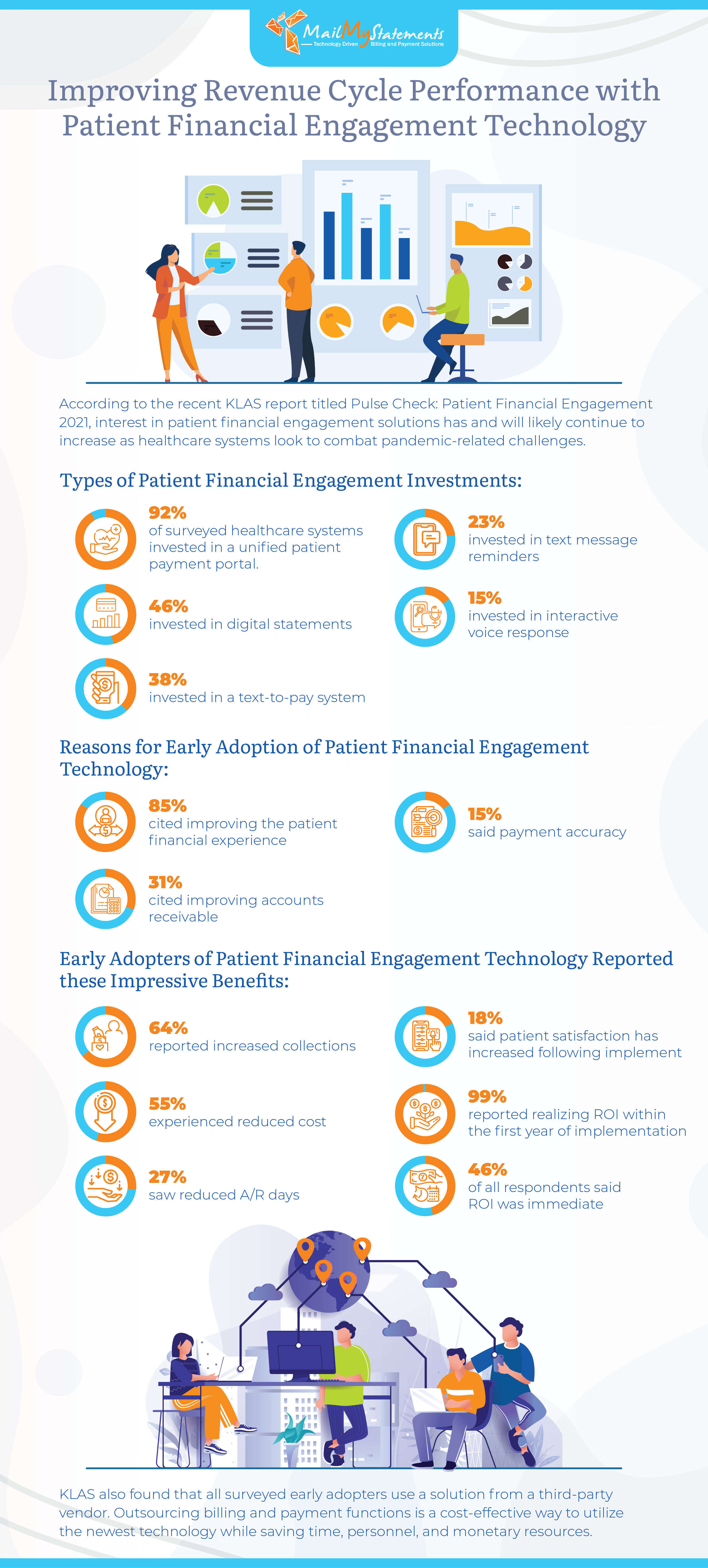

Investing in patient financial engagement can result in significant returns for your practice or billing department. Recent data by KLAS Research reported in Compsmag indicates that 92% of early adopters report the benefits of a unified patient payment portal in improving the patient financial experience.

Other systems that can potentially improve patient user experience include online billing statements, text message and email reminders, interactive voice response systems, and text-to-pay systems. Explore the advantages of using new tech solutions to enhance both revenue and patient-provider relationships.

Real-time cost savings

In the KLAS study, which looked at providers and practices who have already adopted patient financial engagement systems:

- 64% of participants said their collections rate improved

- 55% spent less money on billing

- 46% of respondents reported an immediate return on investment

- 27% reduced the number of days spent in accounts receivable

In addition, all but one of the surveyed financial leaders saw a return on their tech investment in the first 12 months. Many found that these tech initiatives strike the rare balance of increasing practice revenue and improving the patient experience simultaneously.

Lower overhead costs

A study published by the Journal of the American Medical Association broke down the average cost and time spent on billing for different types of patient engagements. By implementing an online billing system, your practice or hospital can potentially save:

- $20.49 and 13 minutes for a primary care visit

- $61.54 and 32 minutes for an emergency department visit ending in a discharge

- $124.26 and 73 minutes for an inpatient hospital stay

- $170.40 and 75 minutes for an ambulatory surgical procedure

- $215.10 and 100 minutes for an inpatient surgery

Fewer billing errors

Preservice screening, available through many patient billing platforms, is a key way to reduce the time and money spent on patient billing. This process reduces errors and billing delays by matching the scheduled patient to the right medical record, confirming insurance coverage and eligibility for service, and helping the patient understand their financial obligation in advance.

Preservice screening improves fast, accurate claims processing and results in fewer denials, which in turn improves patient satisfaction and loyalty to your practice. Research reported by Payments Journal found that:

- 42% of patients said they would not return to a provider after receiving an incorrect bill

- 34% of patients said they would seek care elsewhere if a practice had a disorganized or confusing billing experience

- 33% of patients doubt the accuracy of their medical bills

- 26% preferred a practice that supported alternative payment methods such as PayPal

Reduced denial rates

Practices that incorporate tech solutions have fewer billing denials because of the improved speed and accuracy. The types of demographic and geographic errors reduced by preservice screening represent 61% of initial claims denials, according to data published by Becker’s Hospital Review.

Writing off denials can result in millions in lost revenue, even for a small hospital. Becker’s notes that even a 5% claims denial rate at a 300-bed hospital could result in $10 million in lost annual revenue. If you find your practice is losing money to denial write-offs, consider a platform that flags claims at a high risk of denial so you can address issues before submitting them for reimbursement.

Better patient-provider relationships

Surprise bills can seriously damage a provider-patient relationship. Kaiser Family Foundation reported that more than two-thirds of health care consumers have concerns about receiving unexpected medical bills, and 40% of these individuals received at least one such surprise bill in the 12 months prior to the survey.

Online payment portals provide patients detailed information about the cost of their services and even let them set up and manage payment plans through the same easy-to-use dashboard. We’ve found that when our clients offer patient payment plans, they see an increase in appointments and more consistent collections over time.

Tech solutions also help practices provide accurate cost estimates, increasing patient trust by improving transparency. Despite the importance of a clear, transparent estimate, a 2018 report published by JAMA Internal Medicine found that 44% of hospitals cannot provide an accurate estimate for services, an increase of 30% since 2012.

Your practice’s payment experience has a significant impact on patient loyalty. Payments Journal reported that more than three-fourths of patients consider the billing and payment experience when selecting a new medical provider. In addition, 45% of respondents said transparency was the most important aspect of their health care experience, and 45% cited cost and transparency as the key factors driving loyalty to a specific provider. Additionally, 50% of patients would consider switching to a different provider for a better payment experience.

Expanded patient demographics

Implementing user experience solutions like online payment portals can also help you attract new demographic groups and retain existing patient populations. In fact, 48% of patients across all age groups opt into digital payment notifications and billing when available, although adoption rates are highest among Generation Z (those born from 1997 to 2003). Only survey respondents born from 1928 to 1945 preferred paper billing to online systems.

Whether you’re new to high-tech patient financial engagement solutions or have been researching this type of tech for some time, MailMyStatements can help you with smart software and services that drive better billing and higher revenue. Connect with our team today to see if our winning solutions may be a good fit for your practice.

![]()