Why Patients Love Payment Plans (and How You Can Too)

Ensuring predictable cash flow and sustainable revenue cycles within the healthcare industry has become increasingly challenging, primarily due to the complexities of patient payment collection. With a significant rise in high-deductible health plans (HDHPs) and a growing number of uninsured patients, patients are increasingly burdened with out-of-pocket expenses. This, in turn, has made it difficult for providers to promptly collect full payments.

Additionally, the impending transition to value-based reimbursement models will further shift the financial responsibility onto patients. This trend will exacerbate the challenges faced by providers in collecting patient payments.

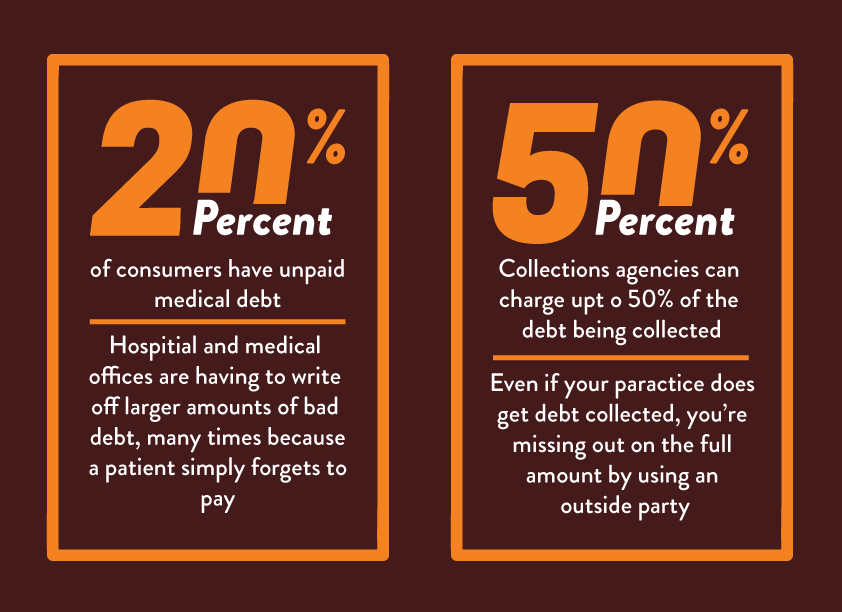

The negative impact of uncollected patient payments on the financial health of medical practices is undeniable. Studies indicate that providers typically recover less than 16% of outstanding fees through collections agencies, and a significant majority of practices identify slow payments from HDHP patients as their primary collection challenge.

Implement Patient Payment Plans to Increase Collections

The truth is that most patients don’t have the cash at hand to cover large medical bills. Demanding a one-time payment will simply deter them from making any payment at all.

Instead, medical practices should aim to collect a smaller amount but more frequently. By offering a patient payment plan, you can get paid sooner and collect more outstanding balances.

You should work with patients’ financial capabilities and design payment options that will increase the likelihood of receiving payments while reducing the financial burden on patients. This will create a better patient experience that increases retention rates and referrals.

Not to mention, a payment plan allows you to have more visibility into your cash flow, so you can manage revenue cycles and achieve better financial health for your practice.

How to Increase the Effectiveness of Patient Payment Plans

To implement a patient payment plan cost-efficiently, you should standardize the payment solutions so you can simplify the patient experience, streamline operations, and reduce errors.

Because most consumers are used to paying bills and managing their relationships with service providers digitally, you should allow patients to process their payments via an online patient portal.

When patients enter and save their credit card information using an online patient portal’s card-on-file service, you can automatically process payments each month without having to wait for patients to initiate the transaction.

Not only will you get paid on time, but you’ll also be offering a convenient service that will augment the patient experience.

Final Thoughts

The ability to increase patient payment collection will directly affect the cash flow and financial health of your practice.

By offering patient payment plans, you can increase collection, improve the predictability of your cash flow, and boost the patient experience. It’s vital to choose an online patient portal that has proper security measures in place (e.g., being HIPAA and HITRUST compliant) to store patient and credit card information so you can rest assured that the sensitive patient data is protected, allowing you to stay compliant at all times.

MailMyStatements offers clients the ability to choose from established merchant vendors in the healthcare industry. Our partnership varieties offer an exceptionally smooth and personalized onboarding experience, eliminating disruption and streamlining the user experience. These platforms offer additional technology like automatic payment withdrawals and next-day funding. Learn more about these options today!

LEARN MORE ABOUT HOW OUR SOLUTIONS CAN SAVE YOU TIME AND MONEY!

![]()