5 Digital Patient Payments Services to Increase Collections

The medical sector is witnessing a significant shift towards greater patient financial responsibility, impacting healthcare practices’ traditional revenue models. Consequently, industry initiatives are prioritizing efficient patient collections alongside government and commercial payers.

This evolution in the revenue cycle demands a patient-centric approach, focusing on convenience and preferred payment options. With patient collections representing over 30% of industry revenue, integrating advanced patient payment services into billing systems is no longer optional, but essential.

By adopting these five digital patient payment services, healthcare providers can incentivize timely payments, enhance debt collection effectiveness through preferred methods, and ultimately unlock revenue growth via streamlined patient collections.

Cloud-Based Digital Patient Payments Services

Implementing a cloud-based patient billing system provides the framework to include advanced and secure technology functions that assist with patient payment collections. Artificial intelligence, machine learing, and blockchain technology help automate and improve the accuracy of various collection functions, helping to increase practice revenues while reducing monetary and personal resources.

AI

Artificial intelligence serves to automate tasks such as patient eligibility verification, claim processing, and payment reminders. Additionally, this technology can analyze patient data to identify those who are at high risk of defaulting on their payments. Providers may use this information to target these patients with specific interventions, such as financial counseling or payment plans.

ML

Machine learning technology helps improve the accuracy of AI-powered predictions. For example, ML can be used to train AI models to identify patterns in patient data that are associated with payment defaults. This information can then be used to improve the accuracy of AI-powered predictions, which can lead to more successful patient payment collections.

Blockchain

Blockchain technology creates a secure and transparent record of patient payments. This helps reduce fraud and errors while simplifying patient payment tracking and identifying those who are delinquent. Blockchain technology may also assist with creating a more efficient and cost-effective payment processing system.

Text Message Payments and Reminders

Text message payments and reminders are a digital patient payments service that allows for seamless access to paying medical bills on the go. Integrating this secure and powerful system allows medical staff to engage patients with a simple text message, which is exactly what patients want. In fact, 89% of consumers want to use text messaging to communicate with businesses.

Text payment reminders reach the patient directly and provide secure access to complete their payment either via linking to their secure portal, or via text message response. Patients who are reached in their preferred method are much more likely to make the requested payment.

Card-on-File Enabled Patient Payment Plans

Among all payment options a healthcare organization can offer, research shows that a credit-card-on-file (CCOF) enabled payment plans may be one of the best. The number of patients who indicate they would be comfortable paying medical bills of $200 or less with a pre-authorized card-on-file surpasses 75 percent. Medical providers have a significant opportunity to reduce the cost of billing and collect patient payments through a CCOF program. This payment option can both reduce the number of days in patient AR and positively impact revenue cycle management.

“A comparison of our recent studies indicates a strong need for digital payment options to improve patient collections processes and increase patient satisfaction. The organizations that can fully embrace digital payment options, such as credit card on file [and] automated payment plans… stand to benefit the most as healthcare consumerism continues to impact the industry.”

~ Phil Dolan, Chief Marketing Officer, Navicure

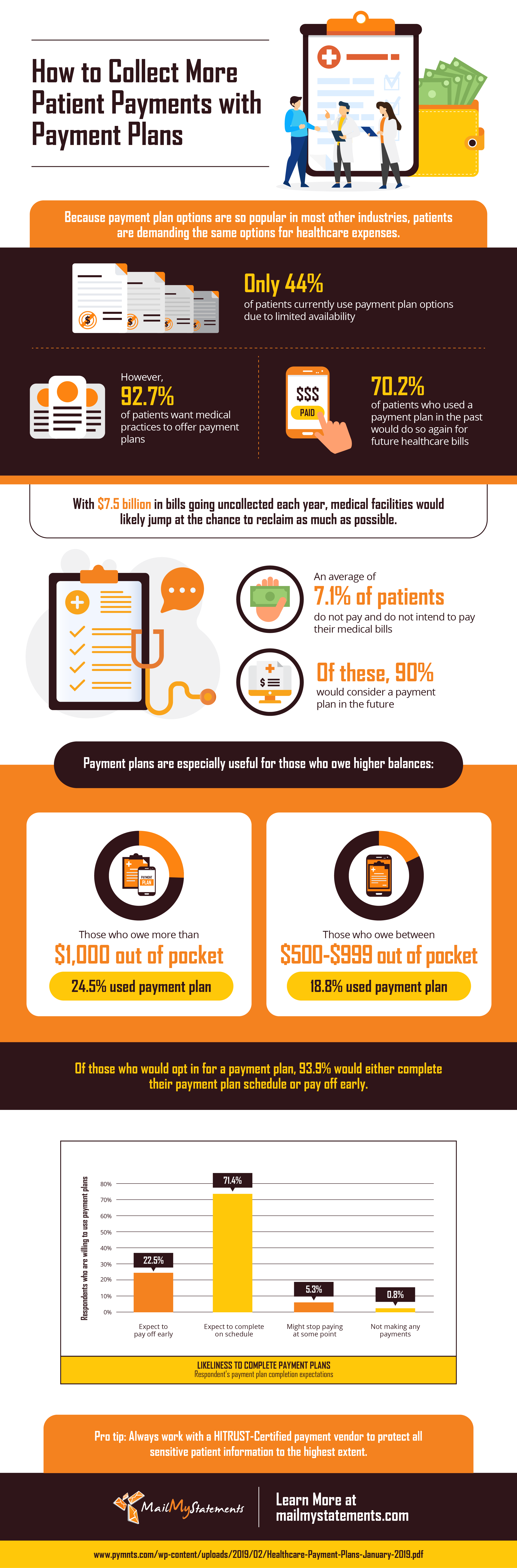

Payment Plans

Difficulty paying healthcare bills has adverse effects on both patients and providers. Not only do unpaid bills delay the hospital’s revenue collection, but out-of-pocket-costs can dissuade patients from seeing a doctor entirely. In 2019, up to 33% of Americans reported that either they or a family member had delayed treatment for a medical condition because of costs (that’s the highest this percentage has been in at least the last 20 years).

A payment plan option can help alleviate patient anxiety, ensure stable revenue collection, and build trust between both parties. Most importantly, a payment plan can re-introduce consistency into your institution’s billing cycle by decreasing the number of late payments.

QR Code Digital Patient Payments

A quick response code is a type of bar code that easily scans with a smartphone or other mobile device, usually individualized for a specific action. When being used in patient payment services, scanning the QR code automatically brings up the payment page or patient portal so patients can verify and pay their bill in a matter of seconds. Because nearly every smartphone comes with a QR code scanner in the device camera, this method allows patients to make fast and secure payments at any time.

Mobile Payments

Mobile payments have increased dramatically in recent years because of security and convenience. In fact, 20% of healthcare bill payments are made from a mobile device. Mobile payments allow patients to self-manage their medical bills via a secure, personal payment portal. They can make payments on the go or at any time of the day.

Providers who offer mobile patient payment services usually indicate this capability on a paper statement with directions (or even a QR Code) on how to access their bill online, then submit a payment. Additionally, providers who offer eStatement communications can securely link the patient payment site directly from the digital statement. Doing so can simplify the payment process by reducing both time and confusion for patients.

Final Thoughts

Although these simple, digital patient payments solutions seem like a no-brainer, most healthcare practices are lagging in implementation.

Medical providers have a significant opportunity to drastically increase patient collections while positively impacting the revenue cycle. Simply offering these payment options creates convenience, security, and clear communication with patients.

MailMyStatements provides clients the ability to choose from high-quality merchant vendors like Clearent. These partnership varieties offer an exceptionally smooth, efficient, and personalized onboarding experience that eliminates pain and disruption, allowing for a streamlined user experience. Get in touch today to learn more about our easy onboarding process today.

LEARN MORE ABOUT HOW OUR SOLUTIONS CAN SAVE YOU TIME AND MONEY!

![]()