5 Benefits of Outsourcing Bank Statement Printing and Mailing

Bank statements play a critical role in the financial industry, offering valuable account activity data and facilitating crucial payment information. However, in an increasingly competitive landscape and with rapid technological advancements, financial institutions must prioritize brand growth and maintain relevance. Bank statement printing and mailing internally consumes significant time and resources, diverting attention from core activities.

Outsourcing these processes enables banks to focus on key areas like enhanced customer relationships, strategic marketing initiatives, and robust compliance oversight. Partnering with third-party vendors streamlines statement production and frees valuable employee time. These providers often leverage features such as customizable designs and secure mailing systems to further enhance operational efficiency.

By eliminating non-essential administrative tasks, banks can reallocate resources towards internal development, fostering innovation in product offerings, addressing customer needs effectively, and forging stronger partnerships. This strategic shift fosters agility and responsiveness, empowering financial institutions to thrive in the dynamic environment of the modern banking industry.

5 Benefits of Outsourcing Bank Statement Printing and Mailing

Outsourcing simple, day-to-day administrative duties to third-party mailing services can reduce unnecessary overheads and boost business. Here are five benefits for employing bank outsourcing services for all of your statement printing and mailing needs:

1. Keep Track of Bad Address Reports

On average, 10% of the population moves every year. If inaccurate data is not corrected, the number of bad addresses in a bank’s database will continue to grow. Asking in-house staff to verify and update old addresses may pull them away from more vital tasks. Third-party vendors have the time and expertise to track existing mailouts and ensure any bad addresses have been removed or updated.

The USPS National Change of Address (NOCA) system is updated every time a resident notifies them of a move. Licensed mailing services are granted access to this list and can automatically update bad addresses with new ones. As a result, less mail is lost or returned to the sender. If discrepancies appear in the database, mailing services can remind consumers to update their contact details with the bank.

Financial institutions are not granted access to NOCA’s list and are left to rectify bad addresses manually or through patchwork systems. Banks must turn to licensed third-party vendors to ensure that vital compliance inserts or private monthly statements are delivered to the correct address. Airtight mailing services help to build trust between banks and account holders. Therefore, it is in the interests of both customers and banks to outsource these tasks to qualified parties.

2. eStatement Options

In recent years, there has been a growing demand for more efficient payment-processing systems and ‘greener’ practices. JPMorgan Chase spent $11 trillion on banking technology in 2019, with Wells Fargo, Citibank, and Bank of America not far behind. Electronic statements allow customers to review their financial activity quickly via email or smartphone applications. Outsourcing these services to a third-party gives smaller operations the ability to keep up with rising tech trends without breaking the bank.

97% of millennial respondents from Business Insider’s Intelligence’s Mobile Banking Competitive Edge study stated that they regularly use mobile banking applications. With 89% of all respondents claiming the same, it is easy to see why banks are investing in new technologies. Paper statements are susceptible to damage and can become lost in stacks of unopened mail. As a result, consumers may be unaware of urgent overdraft limits or bank fees. Sending eStatements directly to a customer’s smartphone or computer gives him or her the opportunity to monitor, store, and sort through the data easily. Click-through payment buttons can also be used to simplify the bill-pay process and increase collections. Setting up intricate mobile banking systems can take time. However, enlisting the help of third-party vendors to manage and distribute eStatements gives banks the benefit of mobile banking without the hefty setup costs.

3. Include Valuable Inserts

By including seasonal promotions or urgent announcements alongside monthly statements, banks can consolidate important communications and save money. Account-holders can learn about exciting new products and exclusive promotions while viewing valuable account details. There are a variety of insert options available to banking institutions, such as compliance updates, promotional deals, and late-fee notices.

Changes in strict banking regulations can be communicated to customers quickly and securely through established channels. Outsourcing these duties to a third-party vendor allows banks to focus on refining their marketing or compliance strategies instead of handling the cumbersome task of distribution.

Over the past few years, companies have become increasingly interested in digitalization. Although this trend is reflective of society’s growing interest in smart technology, studies have shown that 45-75% of consumers would still prefer to receive paper bills, even if they opt to pay for charges online. Therefore, any additional correspondence sent with paper statements may have a higher viewing rate than it would if sent electronically.

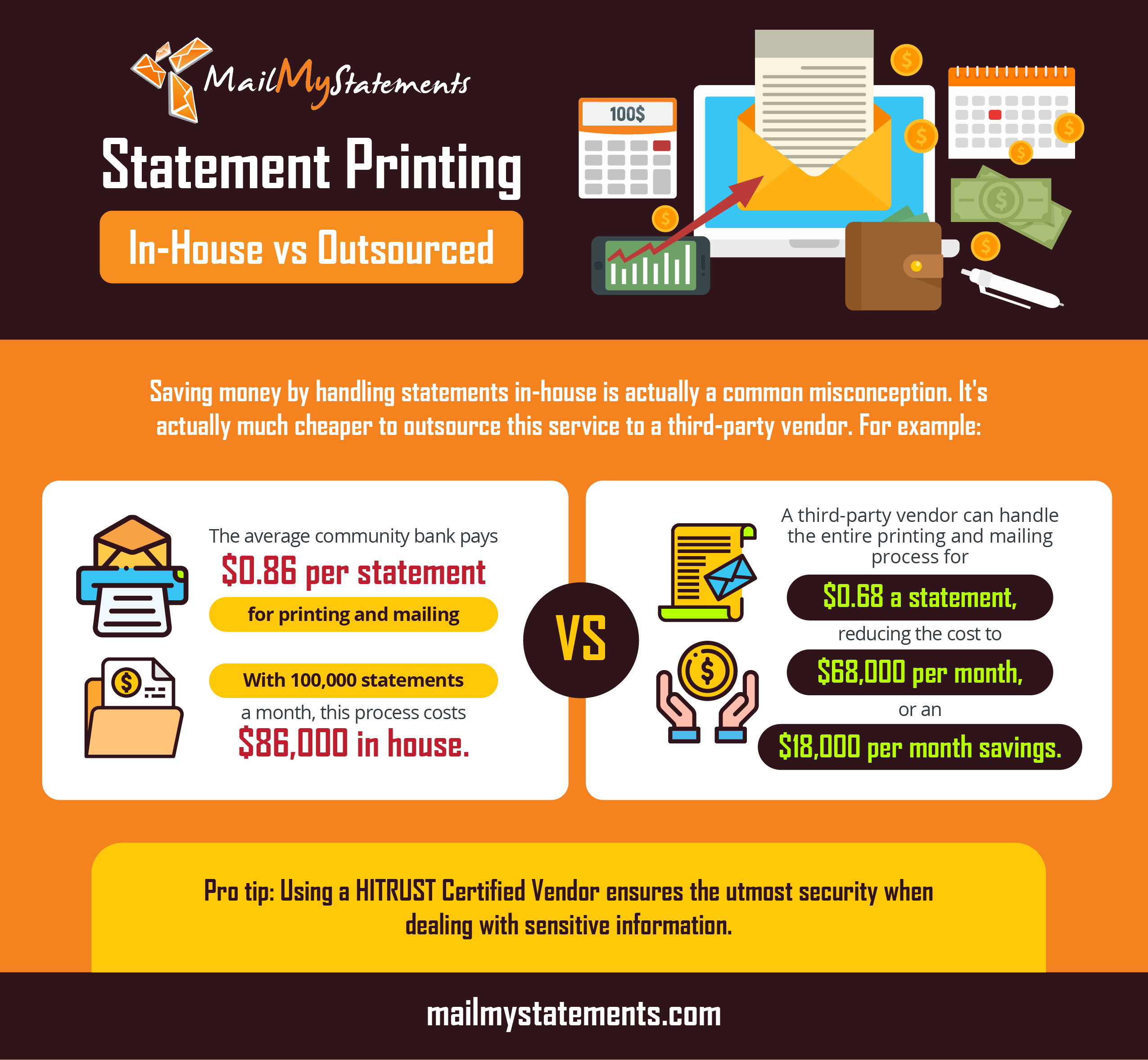

4. Cost-Effective Solutions

The cost of supplies, such as stamps, paper, ink, and envelopes, can quickly add up, especially as these costs are often coupled with the wages of those overseeing operations. A study conducted by The National Federation of Independent Business (NFIB) found that companies with over 20 employees spend $1,000 per month on postage alone. This figure does not include the array of supplies, operational costs, and overheads associated with in-house mailing teams.

In fact, the average community bank pays $0.86 per statement. Let’s say you send 100,000 statements each month. That totals to $86,000 in monthly expenses to send paper statements in-house.

A third-party vendor, like MailMyStatements, receives bulk discounts and can offer the same service for $0.68 (or less) per statement. Now, your 100,000 monthly statements only cost $68,000, reducing statement costs by $18,000.

A second study sponsored by CDW surveyed banking executives on annual spending habits and objectives. The study revealed that 78% of respondents declared customer experience and fueling efficiency as top priorities. Outsourcing statement mailouts to third-party vendors can help banks achieve both of these objectives. Specialized vendors use streamlined systems that can increase printing and mailing efficiency rates, allowing institutions to re-focus their efforts on improving the customer experience.

5. Improved Statement Design

As previously stated, improving the consumer’s experience is a top priority for banks. Third-party vendors condense the complicated jargon used within the banking industry into simple, conversational prose. Clutter-free, simple statement designs allow recipients to read through important information without becoming overwhelmed or confused. Furthermore, billing statements that use personal, easy-to-understand content can help lower financial-related anxiety in consumers.

The use of color and thoughtfully placed text can help highlight important information and improve communications. Branding can also be incorporated to promote uniformity across marketing materials. Consistency builds trust between businesses and consumers. Therefore, if account holders recognize the branding of mailed literature, they may be more inclined to trust the source and read the contents.

Statements are a regular form of communication between banks and their account holders. Outsourcing bank statement printing and mailing services to third-party vendors is not only fiscally responsible, but it can help improve customer relations and free up resources.

Get in touch with MailMyStatements to learn about our HITRUST Certified, technology-driven solutions.

LEARN MORE ABOUT HOW OUR SOLUTIONS CAN SAVE YOU TIME AND MONEY!

![]()