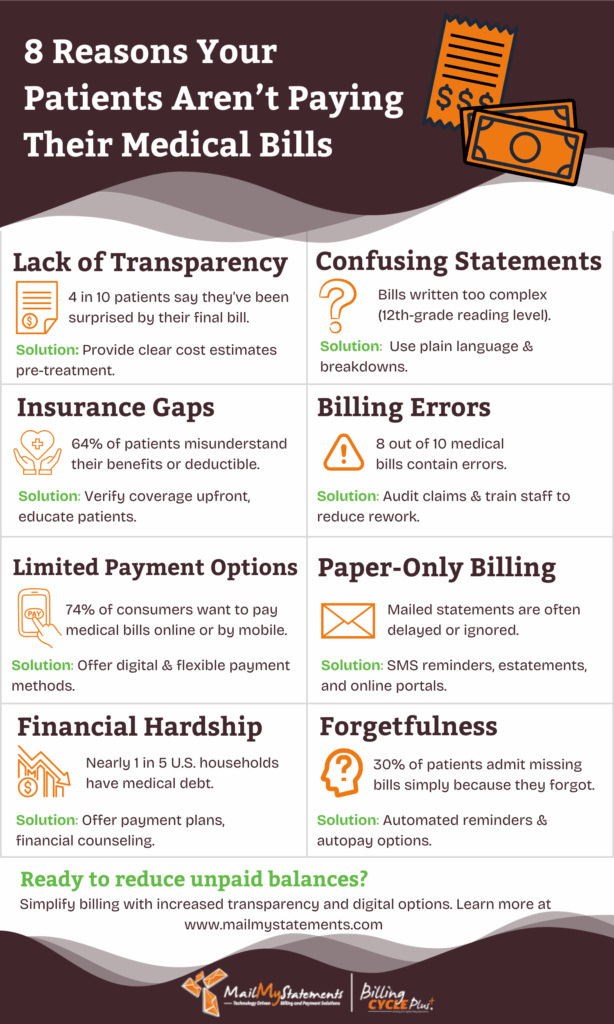

8 Reasons Your Patients Aren’t Paying Their Medical Bills

Healthcare providers and billing professionals frequently encounter challenges with outstanding patient accounts. A significant portion of daily operations may involve pursuing overdue payments and mitigating the financial consequences of unpaid balances.

Understanding why medical bills go unpaid is the first step toward developing effective strategies to address these issues. Below, we discuss some of the most common reasons patients don’t pay their bills and ways to overcome them.

1. Lack of Transparency

A significant number of patients face financial hardship in meeting their healthcare expenses due to the escalating costs of medical care in the United States. While this financial strain is understandable, the lack of transparency surrounding the pricing of treatments and procedures intensifies the issue.

Without clear, upfront information about what healthcare services will cost, patients are frequently caught off guard by their medical bills. The result is a significant financial burden on patients, as well as feelings of distrust and frustration with the healthcare system, and with their providers more specifically.

Solution: Improve cost transparency by providing patients with clear estimates of what they’ll owe after insurance reimbursement prior to offering treatment or services. While these are only estimates, a ballpark figure can give patients a better idea of what to expect and whether their budget should dictate a less expensive alternative treatment.

2. Confusing Billing Statements

Medical bills are often complex and difficult for patients to understand. This lack of clarity can contribute to confusion and uncertainty regarding the patient’s financial responsibility. The presentation and formatting of medical bills frequently lack patient-centric design, leading to a stressful experience, particularly for individuals recovering from recent hospital stays.

Solution: Simplify billing statements by using plain language to explain charges and include a detailed breakdown of services rendered, insurance payments, and patient responsibility.

3. Inadequate Insurance Coverage

Patients may find themselves in dire financial straits when they realize, often too late, that their insurance provides far less coverage than anticipated. This leaves them with out-of-pocket expenses that are more than they expected or can afford to pay.

Solution: Verify insurance coverage and benefits before providing services. Educate patients about their insurance policies, including network differentials and any deductibles, copayments, and coinsurance, to prevent surprises. For patients who lack sufficient coverage, offer easy-to-use payment plans to help put necessary treatments within reach.

4. Billing and Insurance Errors

Errors in billing or insurance adjudication, which may include problems like incorrect coding, missing information, or discrepancies in patient information, may disrupt your practice’s financial workflow. These issues lead to delayed payments from patients while they work with your practice or their insurance company to straighten things out.

Solution: Implement a robust review process for all claims before submission to catch and correct errors early. Regularly train billing staff on current coding standards, regulation shifts, and insurer requirements.

5. Lack of Payment Options

A standardized approach to patient payments may not adequately address the diverse needs of the modern healthcare experience. Patient preferences for payment methods vary significantly. For instance, while older patients may prefer traditional methods like mail-in check payments, younger demographics may favor digital payment options via mobile devices. Furthermore, the ability to pay the full balance upfront may not be feasible for all patients, necessitating flexible payment plans.

Solution: Ensure your practice utilizes a patient payments system that includes a variety of options, like secure, mobile payment portal access and SMS Text-to-Pay.

6. Paper Billing Process

Today’s patients expect the option to handle their medical bills online. Without an online payment platform, your practice appears behind-the-times—and you’re likely extending your revenue cycle by making it more difficult and time-consuming for patients to pay their bills.

Solution: Transition to a platform that allows patients to view, manage, and pay for their healthcare services online, starting with digital communications via SMS or eStatements.

7. Financial Hardship

Many patients find themselves in a position where they cannot afford to pay their medical bills. This situation can arise from a variety of factors, including unexpected healthcare costs, loss of employment, or insufficient insurance coverage, leaving individuals struggling to manage their healthcare expenses.

Solution: This is another issue where having payment plans can help. Without an option for paying in installments, many patients take an all-or-nothing approach to paying outstanding medical bills, waiting until they can pay in full before taking care of their balance.

8. They’re Forgetting About It

Yes, it happens—especially when still mailing medical bills – which can lead to patients neglecting or overlooking these important documents. Some patients need a few reminders that their payment is due.

Solution: A combination of online billing and automated reminders will help give patients the gentle nudge they need to submit their payments. Or, even better, set up automated payments. This frees up staffs time, and is much more effective than sending reminders in the mail.

The Bottom Line

Unpaid medical accounts pose a significant challenge for all healthcare providers. However, the underlying causes and potential solutions are often straightforward. By identifying the root causes of these outstanding balances and implementing effective strategies to address them, practice managers and medical billing professionals can significantly reduce the amount of unpaid bills.

Get in touch with us today and learn more about how MailMyStatements’ BillingCycle Plus software can help streamline your patient billing and payment collection process with digital tools like eStatements, SMS text message payment alerts and reminders, and machine learning chatbots.

![]()